Ajay Kumar Srivastava, MD & CEO, IOB at a press conference in Chennai on July 18, 2025.

| Photo Credit:

BIJOY GHOSH

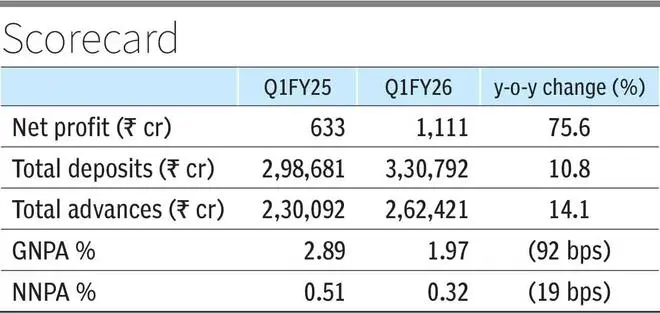

Public sector lender Indian Overseas Bank (IOB) continued its strong momentum into FY26, recording a 76 per cent y-o-y growth in net profit in quarter ended in June 2025 (Q1 FY26) to reach its highest-ever profit levels of ₹1,111 crore.

Profitability was driven by high growth in both interest and non-interest income along with lower provisions.

The other income component increased 43 per cent to ₹1,481 crore, and net interest income, the core income of the bank, increased by 12.5 per cent y-o-y to ₹2,746 crore.

Gross advances increased by 14.1 per cent to ₹2,62,421 crore but the majority growth came from RAM (retail, agri and MSME) loans (25 per cent y-o-y growth). In contrast, corporate and other loans of IOB shrunk from ₹58,002 crore in June 2024 to ₹51,450 crore in June 2025.

Robust growth

“There is not much demand as we expect from big corporates; capex and projects are not happening. Retail and MSMEs are our core strength and that is growing robust, “ Ajay Kumar Srivastava, Managing Director and CEO of IOB, said.

The RAM portfolio constitutes nearly 79 per cent of IOB’s domestic advances.

The Chennai-headquartered bank, which has received board approval to raise capital of ₹4,000 crore in FY26, is in the process of closing this raise by end of Q3, largely from qualified institutional placement (QIP) mode.

“This will bring down the government stake in the bank by around 4 per cent,” he said.

Total deposits increased by 10.75 per cent to touch ₹3,30,792 crore as of Q1FY26. We have been able to maintain CASA Ratio at around 43 per cent, and are among the three banks with CASA over 40 per cent, Srivastava said. CASA Ratio improved by 161 bps to 43.8 per cent as of June 2025.

IOB’s asset quality has also steadily improved. Gross non-performing asset (NPA) stood at 1.97 per cent from 2.89 per cent in the year-ago period, while net NPA improved to 0.32 per cent from 0.51 per cent in June 2024.

Total recoveries during the quarter amounted to ₹851 crore, including those from written-off accounts, compared with ₹582 crore in Q1 FY26.

While net interest margins marginally declined in the quarter, likely due to the rate cut action by Reserve Bank of India, the MD-CEO said that in one or two quarters, we should be back to the same levels of net interest margin as earlier.

We expect a total business growth of around 12 per cent in FY26 in line with last year’s performance, said Srivastava, adding that they have a credit growth target of 12-13 per cent for FY26.

We are confident of growing profitability in successive quarters, he added.

Shares of the public sector bank closed the trading day flat at ₹39.78, on the Bombay Stock Exchange.

Published on July 18, 2025

Source link

[ad_3]

[ad_4]