Results announced today were unexciting, somewhat below expectations.

Down by 18 per cent in the last one year vs Nifty 50’s decline of 2 per cent, down by 29 per cent from its all time highs in September 2024 vs Nifty 50’s decline of 15 per cent, and up by around 83 per cent in the last five years vs Nifty 50’s up move of 146 per cent – the stock of TCS has been a disappointment whichever way one tries to dissect its performance.

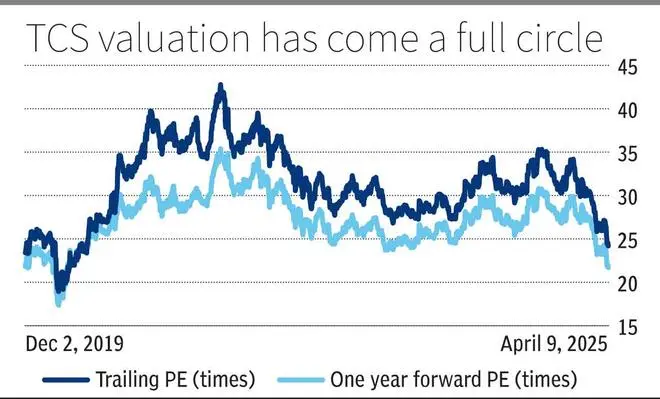

bl.portfolio had recommended investors to book profits in the stock of TCS in January 2021. Since our call, TCS is flat while the Nifty 50 is up by 56 per cent. However, as a byproduct of this underperformance, a sizable valuation derating has played out in the stock of TCS after investor euphoria in 2021 caused an unjustifiable but sizable valuation rerating. For the first time in 5 years, the stock is now trading in line with its pre-covid valuations. Pre-covid (December 2019) and 5 year average valuation running up to December 2019 is something that we at bl.portfolio had been consistently suggesting as the benchmark for investors to use to evaluate expensiveness or cheapness of the stock. Today at a trailing PE of 24.2 times vs 23.04 times in December 2019 (5-yr average at 22.7 times then) and one year forward PE at 21.6 times vs 21.8 times in December 2019, a case can be made that valuation forth in TCS has been fully crushed out. But does it mean investors can consider buying the stock? Here, its important to take stock of few things.

Results announced today were unexciting, somewhat below expectations. While Q4 revenue at ₹64,479 crore was in line (Bloomberg consensus), EBIT at ₹15,601 crore was 3 per cent below consensus. Hence EBIT margin at 24.2 per cent missed expectations at 24.9 per cent. FY25’s constant currency revenue growth at 4.2 per cent which can be termed weak is upon an already weak FY24 in which revenue grew 3.4 per cent. This implies two year CC revenue CAGR of 3.7 per cent. As compared to this in the 2 years ending FY20, TCS reported CC revenue CAGR of 9 per cent. EBIT margin since then is marginally down.

Bottomline, the stock is trading at same valuation as in December 2019, but the growth is substantially lower and the headwinds are higher – Trump tariffs and uncertainty, AI disruption and higher global interest rates today. For example the fed fund rate then was 2-2.25 per cent versus 4.25 to 4.50 per cent. Lower global interest rates then made TCS and its payout ratios an attractive bet for FPIs, and domestic investors too benefitted from their demand for the shares. This is absent today.

Macro outlook

Furthermore, management’s comment that FY26 will be better than FY25 (strong order book a source of confidence) is nothing to get excited about as the only inference one can make is that it will be better than the low CC revenue growth of 4.2 per cent in CY25. There is unlikely to be any meaningful growth for the foreseeable future. The macro environment appears bad for now.

Given these, while the shares are not expensive, they are not cheap either. Investors can wait for better entry points and stay on the sidelines for now.

Published on April 10, 2025

Source link

[ad_3]

[ad_4]